Sep 10, 2024 Politics

The Budget came and went and we’re still debating whether there were any meaningful spending cuts and if the tax cuts will fuel inflation, meaning mortgage rates will go up. We’ll learn the Reserve Bank’s verdict in July when it chooses whether to follow through on May’s tough talk. Soon after, the ratings agencies will decide whether to downgrade our credit rating, like they threatened to last year if we didn’t stop borrowing.

No worries, though. With luck, there’ll be no more international crises, peace will break out and Kiwis will save — not spend — their tax cuts. Interest rates will fall in 2025, growth will bounce back and we’ll start repaying our Covid debts in 2028. That’s the government’s fairytale, anyway.

By 2028, the Key, Ardern and Luxon governments will have run cash deficits for 18 of the previous 20 years. Steven Joyce and Grant Robertson get the only two gold stars in two decades for balancing the books, in 2017 and 2018.

Every year, there’s a different excuse. Some are valid — like Covid-19 in 2020 and the Canterbury earthquakes in 2011— but, mainly, governments have been borrowing because they can, after the Bolger–Shipley and Clark governments paid all the debt back, and because MMP voters refuse to pay more tax or have government spending cut.

Whatever Christopher Luxon and Nicola Willis say, government spending isn’t going back to pre-Covid levels, or even close. May’s Budget revealed they’ll spend more this financial year — and every year after — than Jacinda Ardern and Robertson.

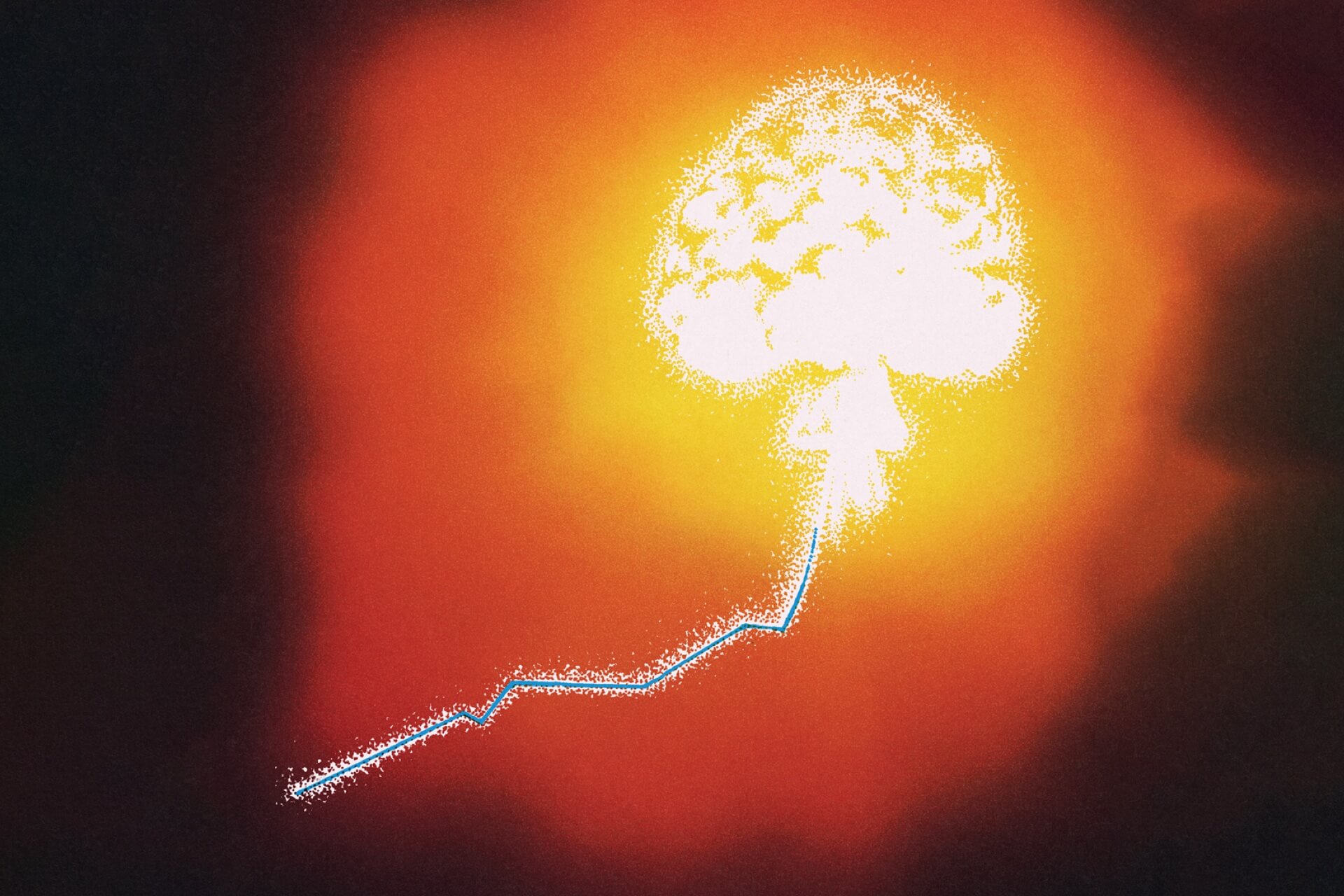

There might be a little surplus or two at the end of this decade. But every forecast shows permanent red ink from 2030, until we default on our debts, probably around 2050.

Whatever politicians say, we’ll then have to radically slash the size of government like we’ve never known before, massively increase taxes, or both. It’s the experience today of Argentina, another country that was among the world’s richest two generations ago and believed that meant it could never be poor, whatever it did.

This column could have been written by Metro’s legendary Bruce Jesson back in the 1980s or 90s, and probably a similar one was. There’s little new or unexpected in the current post-2030 forecasts. From the Lange government in the 1980s, to the Clark government in the 2000s, once they knew the baby boomers weren’t going to have as many babies as their parents, they’ve all known what lay ahead. The problem has never been just superannuation. Governments have known all along that the bigger problem is the cost of health care for boomers when they reach advanced old age. Improvements in medical technologies and pharmaceuticals make this care more expensive, for longer.

There have been attempts to deal with the impending cost blowout. The Lange government tried to means-test superannuitants. They wouldn’t have it. More successfully, the Bolger government progressively raised the retirement age from 60 to 65 over 10 years. Even Winston Peters had a decent go, with his 1997 referendum on introducing a compulsory retirement savings scheme. But since we didn’t like him, 92% of us voted against.

The Clark government tried, too. It introduced the New Zealand Superannuation Fund, now worth $70 billion. But superannuation alone already costs $20 billion a year and will hit $30 billion by the end of this decade, growing thereafter. Even if the Super Fund paid the government a 10% dividend each year (its returns are more like 7%), that would cover less than a third of even today’s costs.

The Clark government’s KiwiSaver scheme was meant to top up superannuation, even though the political left feared it would one day become an excuse to cut the basic payment. There’s probably no need to worry — KiwiSaver funds manage around $100 billion in total, not enough to touch the sides.

Since then, the Key, Ardern and Luxon governments have all decided to leave things as they are, at least until the last boomer is dead. The current plan is to then take superannuation off Generation X and the millennials. Good luck with that.

In any case, the health costs are bigger than superannuation. They’re already more than $30 billion a year, including funding for illnesses, primary care, public health and disability support, plus more besides for accidents through ACC. The post-2030 projections have total government spending rocketing up much faster than the tax take, with governments forced to borrow the difference.

Each year, it gets harder, since debt-servicing costs keep ballooning. They already sit around $10 billion a year, more than the entire school system gets. By the middle of the century, debt servicing will be the government’s second-biggest government cost, behind only health.

Since 2008, no senior New Zealand political leader has been prepared to take any of this seriously. It’s all just been smiling, waving, kindness and whatever Luxon offers. When asked, prime ministers and finance ministers have said it’s all a bit silly, claiming no New Zealand government would ever let a financial collapse happen. But letting it happen is exactly what they’ve all been doing. What they’ve ensured is that a future government, sometime in the 2030s, will suddenly cut government spending by 10 times what Luxon and Willis have even contemplated, or raise taxes by as much. If they didn’t, the cuts would need to be twice as big by the 2040s.

If no one acts before 2050, we’ll default, then have to do it anyway.

Since 2008, our governments have basically decided to borrow New Zealand’s way to economic collapse to help get re-elected. It’s worked. No wonder Act leader David Seymour now says he admires Helen Clark and Michael Cullen, since their fiscal policy was far to the political right of even his own party’s today. The coalition government Seymour props up is just the latest since 2008 to cross its fingers and hope. The only certainty is that a Labour–Greens–Te Pāti Māori government would be worse.

Sadly, there’s probably no longer any way out of this. A record 78,200 New Zealand citizens moved overseas in the year to March. The number fleeing each year will soon pass 100,000. Who’s joining them?