Apr 3, 2014 Property

What’s the best way to earn money from property in Auckland? Buying in the “less desirable” suburbs is a good place to start.

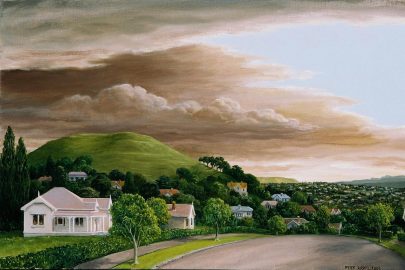

This story was first published in the October 2013 issue of Metro. Illustration by Scott Kennedy, photos by Ken Downie.

Kyron Gosse lives in a rented bedroom of a Mt Wellington house. He survives on just $250 a week, drives a $2000 car, sleeps in a second-hand bed he bought on Trade Me, works at a desk from the op shop and stores his clothes in drawers he’s had since he was 5.

And yet at 26, Gosse already owns five properties and is on track to achieve his dream of being “financially free” on a $100,000 passive income by the time he’s 30. By 50, he could be Auckland’s next Michael Friedlander or Jimmy Kirkpatrick.

Gosse, born five months before the 1987 sharemarket crash, made his first investment at 22, just after the Global Financial Crisis had decimated finance companies and brought banks to the brink of collapse.

Now, with newspaper and television stories every week featuring disaffected would-be first-home owners complaining about Auckland’s unaffordable property market, Gosse is one of the investors quietly building equity by buying up in the down-at-heel suburbs of South Auckland.

“The best investments are never going to be in the best areas, generally.”

With most publicity focusing on the eye-watering prices commanded by run-down Grey Lynn and Ponsonby villas, much less attention has been paid to the juicy returns to be made in the poorer areas of town where investors are cashing in. “The best investments are never going to be in the best areas, generally,” says Gosse.

The extent of the value divide became clear in July when Barfoot & Thompson released its first suburb-by-suburb breakdown of rental yields, with the much-maligned Otara topping a list of 109 suburbs with a 6.65 per cent return, compared with the measly 2-4 per cent yields in the tonier areas of Epsom, Pt Chevalier, Grey Lynn and Devonport.

Of course, it makes sense that lower prices have a greater capacity for higher returns, but the disparity is stark. On August figures, the average Remuera house sold for $1.2 million, yet the area’s average rent is just $670 for a three-bedroom home. Compare that to Otara, where the average house price is $295,000 but the average three-bedroom rent is $375. Other suburbs topping the 5.5 per cent yield threshold are Weymouth (6.36) and Manurewa (5.8).

Gosse believes South Auckland doesn’t deserve the stigma that has depressed property values and says many wary investors would be surprised by the quality of tenants in the area.

A trained chef, Gosse chased higher salaries overseas at 20, working in mines and oil rigs in Western Australia to put together his initial deposits for a house and a section in Paihia, in partnership with his parents. Gosse, who focuses his own investments — and his work as a property finder for other investors — on Mt Wellington, Otahuhu and Mangere, bought his first Auckland house, a four-bedroom property in Walmsley Rd, Otahuhu, for $280,000 last November, soon after returning home.

He couldn’t have afforded the deposit on his own, though — he found a business partner, an old family friend who knew nothing about property but had some capital to invest and wanted to buy rental properties. What she got for her investment was Gosse’s head for a deal. And that’s the result of hours of studying the local markets and walking the streets in the areas he wants to buy. He’ll also visit open homes and go to the supermarkets and shopping malls to size up the locals.

“You can tell who lives in the area by what they’re wearing, what they’re buying, how many kids they’ve got.”

Some investors have a “follow the Coffee Club theory”, Gosse says.

Some investors have a “follow the Coffee Club theory”, he says — if the franchise or a big supermarket chain moves in, they will have spent millions casing the area’s growth potential first, a reassuring signal for property values.

Gosse found his first property by happening on it in a real estate window. “They were asking $309,000. I thought that was really cheap for a four-bedroom house in Otahuhu.”

With his business partner’s investment, and $100,000 revolving credit against his Paihia section, Gosse was able to buy the house and spend $40,000 on two months of renovations, including repainting inside and out, putting a new sink, bench and lino in the kitchen and building a new bathroom. A leaking toilet — being held up by a book to keep it straight — had turned the chipboard bathroom floor to “Weet-Bix”. Little wonder it was “under-rented” at $330 a week and the landlord just wanted to get rid of it.

By March, the property had been let to a family of five for $450 a week, and revalued at $360,000 — an increase of $80,000 on the purchase price, which allowed Gosse and his partner to pull out their money, with the bank agreeing to a 90 per cent loan-to-value ratio.

With the tenants covering the mortgage, Gosse was able to use the equity he’d gained to buy his second Auckland property, a $430,000 home and income in Weymouth Rd, Manurewa. Again, it was his legwork and local knowledge that paid off.

After he visited all the agencies in the area telling them he was interested in buying a rental, an agent emailed him with the details of the property on which the vendor wanted a quick sale. “I got the email at 3pm and rang him straight away.” Gosse, knowing a similar property down the road had just sold for $500,000, was there in 20 minutes and put in an offer immediately.

After a $20,000 renovation over five weeks, which included removing roughcasting over the home’s weatherboard, replacing the lino, painting, landscaping and building a deck and fence, the property was revalued at $495,000 and is now rented at $740 a week. Again, Gosse and his partner used the increased value to take out their money and still have a property with a positive cash flow. The yield on the Manurewa property is 8.4 per cent and on the Otahuhu house 7.5 per cent.

Early in September, he bought his fifth property, a $510,000 home and income in Macky Ave, in what he describes as an “undiscovered” part of Mangere East, where prices “haven’t started going crazy yet”. At $720 a week in rent, the property is achieving much less than he considers it’s worth. After renovations, he expects it to get $830.

Gosse says that while he was initially interested in buying apartments… he turned to houses. He’s glad he did.“The capital growth is in land.”

Gosse says that while he was interested in buying apartments when he first started studying Auckland property investment, the borrowing criteria were much stricter so he turned to houses. He’s glad he did. “The capital growth is in land.”

Within a year, he’s added $140,000 value to his first two properties from an initial $60,000 deposit — an $80,000 gain in equity. “It’s not that impressive from a property point of view, but remember we got that $60,000 back in our pocket to go and do another one.”

They’re paying $1088 a week on the mortgages, including principal, and get $1520 in rent, more than covering property management, rates, repairs and maintenance.

“All the equity we have gained is from using other people’s money [the bank and the tenant].”

He and his Germany-based girlfriend of three years have sacrificed today’s lifestyle for the one they want tomorrow — they plan to have no children until they’re “financially free”. But Gosse is planning for pitfalls ahead. Prudently, he and his business partner are preparing for next year’s predicted interest rate rise and have their fixed and floating mortgage terms staggered so they won’t be “crippled” by the likely hikes.

He reckons that as long as he can go on finding tenants, he’s in a secure situation even if house prices fall.

From his office in Parnell Rd, Auckland Property Investors Association president David Whitburn looks out across the Auckland skyline and asks, “Where are the cranes?”

A decade ago, in the last property boom, the CBD skyline was full of them. Now there are none. But that’s about to change as the city emerges from GFC-induced hibernation, and the Auckland Council’s drive for intensification under its Unitary Plan takes effect.

The plan, says Whitburn, is a game-changer with its new mixed-housing zones allowing higher-density developments.

“Developers are the worst enemy of the investor but it’s all about balance. As the president of the property investors association, I should be saying put up development contributions and make it really hard so we can rark up rents, but I’m not going to say that because it’s about fairness and being part of the community.”

Auckland’s estimated shortage of 30,000 homes and its continuing migration and population growth mean demand will remain high. He also predicts that while the new restrictions on low-deposit loans will hurt, the impact won’t be “massive”. While it will slow growth in prices and inhibit access for first-home buyers, the bigger picture remains the crisis of under-supply.

Whitburn says apartment prices, stagnant for up to a decade, began to climb at the end of 2011 largely based on relative affordability as house prices rose, but also influenced by an easing of bank lending criteria. Arguably, banks still control apartment prices by restricting loans on smaller apartments (less than 45 square metres) to 50 per cent. Owner-occupiers can still borrow up to 80 per cent on standard-sized apartments but investors are limited to 70-75 per cent, depending on the bank. “There’s still a prejudice by the banks against apartments,” he says.

Apartment prices will never match house prices for capital gains, and many investors remain wary of them for a raft of reasons, including the sorts of body corporate issues that have dogged Metropolis.

Other woes have included water-tightness and soundproofing problems, lack of common areas, complex lease or title arrange-ments and the questionable valuation practices that inflated the prices of properties bought off the plans, for example in the Blue Chip scandal.

Some investors were put off by the dire and featureless “shoebox” towers that went up early last decade before minimum sizes and new standards were introduced in 2007. Some were as tiny as 12 square metres; others crammed four bedrooms into 55 square metres — “Nasty stuff,” says Whitburn.

New legislation requires that apartment owners can access body corporate minutes so they’re not ignorant of issues in their block and the annual levy fees. But for every investor who’ll say body corporates make apartment-owning simple, there’s another who’ll be put off by the levies, the potential for all owners to be hit with the sort of huge maintenance bills that have afflicted some apartment blocks and the loss of autonomy inflicted by interfering owners’ committees.

“There’s one block in Otahuhu where I would still be able to buy apartments for less than people paid for them 10 years ago. People took a bath.”

Gosse hasn’t been tempted into apartments because, for him, the sums haven’t stacked up. “There’s one block in Otahuhu where I would still be able to buy apartments for less than people paid for them 10 years ago. People took a bath in that block; in most of the blocks. It didn’t make sense if you were paying half a million dollars for an apartment in the city when you could buy a house on 500-600 square metres.”

While the apartment market has corrected itself to some extent, he says a lot of units are designed for owner-occupiers, so the numbers for an investor might not work. “You need to know what you’re doing, research it, and do it smartly.”

Whitburn expects that in 10 years, Gosse will be doing better with his properties than an investor who specialises in apartments, because of the better capital gain. When Whitburn started investing in 2002, he bought a three-bedroom property in Mangere for $150,000 and rented it at $300 — a 10 per cent yield. The same property, now renovated, has been revalued to $360,000, but the rent is still only $400. “The property has doubled in value but the rent has gone up by a third.”

But there remains less appetite among investors for such suburbs, and apartments can lure those who want to hand management to an agency and who prefer a passive rental income to the hope of future capital gains. City apartments are enjoying a surge in popularity among Kiwis returning from their OE who’ve lived in similar properties and enjoy the proximity of cafes, shops and restaurants.

Martin Dunn, of Auckland apartment sales specialists City Sales, says that until fairly recently, when parents came to him saying, “We want to buy little Johnny an apartment in the city,” he’d say, “No, you want to buy little Johnny a house.”

“When I was saying that, you could buy a house for $350,000. Now I’m saying, ‘Yes, buy an apartment for Johnny and buy it today.’” In the past three years, the price of a studio or bachelor flat has gone from $100,000 to $180,000.

“When the Grey Lynn villa sold for $900,000, a city apartment would sell for $270,000. When the villa went to $1.7 million, the two-bedroom apartment went to $350,000.”

But, even Dunn points out, there’ll only ever be 1400 villas in Grey Lynn. A year or so ago, Auckland had 24,000 apartments — in 10 years there may be 40,000.

Specialist planning consultant Hamish Firth, whose Mt Hobson Group helps developers through the council consent process, is coping with unprecedented demand and says many of the new projects are apartment blocks. In recent months, it’s facilitated consents for the 10-storey, 143-unit Urba Residences in Howe St, of which 90 per cent have already been sold off the plans, and the 273 “executive residences” of the Queens development opposite the Town Hall, where 70 per cent of the titles were sold in three weeks.

“I’m not going to use words like ‘hot’ and ‘bubble’, but this feels like spring. It’s wake-up time.”

“All these developers are confident, not in a cocky way, that demand is there for their product. By the end of next year, there will be 10 cranes on the horizon in the CBD. I’m not going to use words like ‘hot’ and ‘bubble’,” he says, “but this feels like spring. It’s wake-up time. All the stars are aligned for everyone to get going again.”

With the Unitary Plan concentrating the highest-density housing around existing transport hubs and retail malls, there’s likely to be keen interest from investors in remaining land in those areas. Demand is also likely to be intense in Grafton and Newmarket, near the new Auckland University campus on the old Lion Breweries site. “In 15 years, there’ll be 15,000 people there,” says Firth.

While the government and Auckland Council have mandated the building of 39,000 new homes in the next three years, it’s an unachievable goal given it would require a 100-unit apartment block to be built every three days, or 750 hectares of greenfield land to be ready for development every year. “We can’t just click our fingers and an apartment building magically appears,” says Firth.

One of the biggest mistakes most investors make is to manage their own properties. They can be unprepared for the hassle of unexpected vacancies, unpaid rent and damage and sell because of it, or rent for much less than market values. Others don’t adjust rentals regularly for long-term tenants. About 80 per cent of New Zealand landlords manage their own properties — a statistic reversed in Australia.

Barfoot & Thompson director Kiri Barfoot says the company manages about 10,000 properties nationally, charging 7.5 per cent of the rent — a tax-deductible expense. Rents are reviewed every six months. About 20 per cent of the pool is owned by “accidental landlords” who’ve inherited the properties or have headed overseas but don’t want to sell.

She says a lot of investors “wouldn’t have a clue” about yield and she hopes the company’s “data mining” could help convince them to buy another property. Rental prices are increasing about 5 per cent a year, with a case study the company did on a Henderson house showing its rents had nearly doubled in 10 years, from $250 to $480 a week.

So if someone like Gosse can snap up three apparent bargains in less than a year and start making money, why are the rest of us moaning about Auckland’s unaffordable properties?

“Get on the ladder, build up, add some equity and move on. Stop being snobs.”

Whitburn says many buyers needed to change their expectations. “I’ve got friends in leading law firms on $220,000 a year saying it’s too expensive to buy in Remuera and Epsom and Greenlane. Well, yes it is, so I say why don’t you consider a suburb a little further south? They say, ‘Oh, I’ll get mocked for that.’ That’s why they have the BMW, the Audi or the Mercedes leased so they don’t get embarrassed in the work carpark. It’s about ego and vanity, and it happens in the housing market as well. Get on the ladder, build up, add some equity and move on. Stop being snobs.”

Suburb stigma is only part of the story, says Gosse. He says despite the Auckland market being overheated in some areas, it’s woefully inefficient in others. The Macky Ave property he’s just bought was marketed by a small agency and not widely advertised. It didn’t appear on any of the main websites where many buyers would look.

“I caught a glimpse of it once, on the back of a southern Property Press, and inquired about it on the spot. I didn’t see it advertised again anywhere else and there were no signs up in front of the property. People can’t buy properties if they don’t know they are for sale.”

Other properties are referred straight to agencies such as IFindProperty, the one where he works as a licensed buyers’ agent, linking sellers to its database of 3000 investors.

Sacrifice and creativity are two of the keys to successful investing, he says. “There are many ways to buy a house and getting a mortgage is just one of them.”

The bargains are still around — but only for those who don’t overlook the do-up dungers in the down-trodden south.