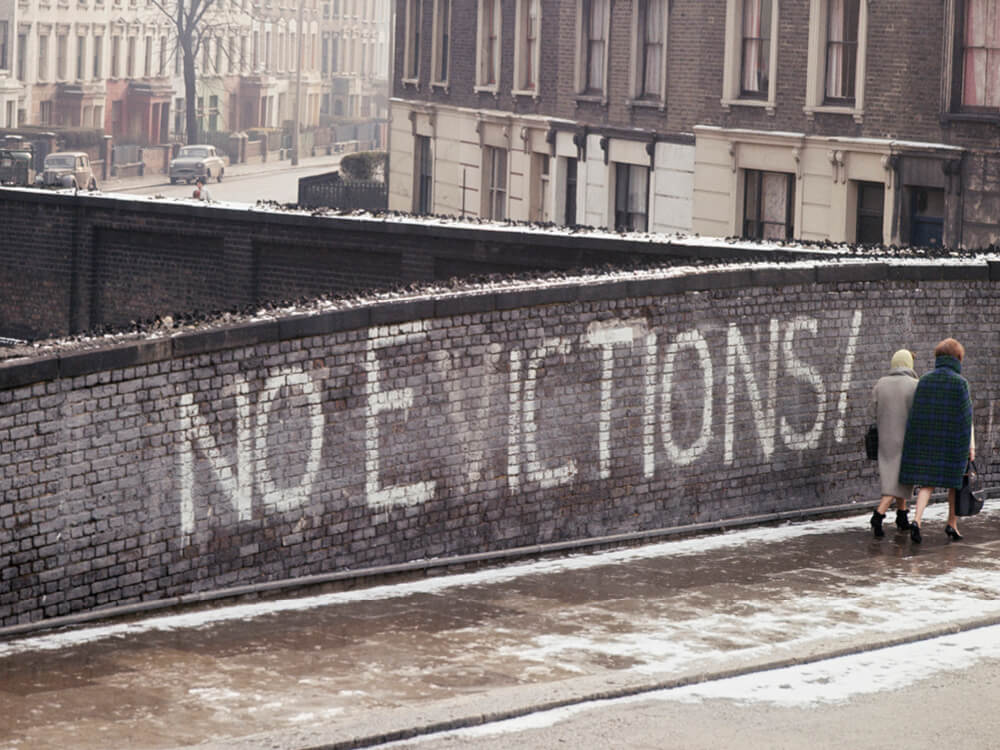

Mar 28, 2020 Property

OPINION: It’s time to expand our imaginations when it comes to the measures we can take to mitigate the economic impacts of coronavirus, and the current month-long lockdown, on ordinary people. We should at least consider the possibility of a rent holiday.

I’ve been turning an idea over in my head for a couple of days – ever since Grant Robertson announced in a stand up that there would be a mortgage holiday for homeowners but no analogous rent holiday for renters: What if renters who lost their incomes in the coming months didn’t have to keep paying rent?

Shouldn’t we at least consider it? Even as we face a recession which is by all estimates about to bite harder than the financial crisis of 2008, why does it appear to be beyond the pale to suggest that landlords should prepare to cop financial losses like everyone else?

What this whole crisis highlights – as an enormous number of people seriously consider (some for the first time) how they’ll afford to keep a roof over their and their family’s heads – is how housing is a human right and how we don’t, as a country, take that seriously enough.

To be clear, it’s good that homeowners are going to be given a six month mortgage holiday if their income is affected by Covid-19. That’s an immediate relief many will need and will hopefully stop a bunch of people’s homes being taken off them by the bank. But why shouldn’t renters be offered similar relief? A freeze on rent increases is good, but why shouldn’t we at least consider taking things further by offering a rent holiday too?

When the mortgage holiday for homeowners whose jobs were affected by the Covid-19 pandemic was announced on Wednesday, a journalist asked Grant Robertson, “What about renters?”. Robertson answered that was what the wage subsidy scheme was for – to keep people’s incomes more or less the same, so they could keep paying rent. Mortgage holders have access to that scheme too. Surely what’s good for the goose is good for the gander?

Alright, so lease owners will end up paying the full extent of their mortgage eventually (plus a little extra, if interest accrues over the ‘holiday’ period), whereas a renter may never pay back the missed rent. To put it bluntly, who cares? I seriously wonder how much a few months of missed rent should matter, if the alternative is putting more financial pressure in the short term on a group of people who are, almost by definition, more economically vulnerable than their home-owning counterparts?

At a press conference yesterday afternoon, Jacinda Ardern was questioned on the issue of renters being sent warnings about evictions if they didn’t pay (though they weren’t named, the property management company involved was almost certainly Quinovic). Again, this was on the eve of a pandemic lockdown, as many people face joblessness. The Prime Minister said this was operating outside the (new) law and asked people to think about the nice landlords who were complying or even dropping rents. Yes, some landlords are nice people – lots of wage earners about to lose their jobs are nice people, too. The thing is, if my landlord is threatening to kick me out if I can’t pay after 60 days (which they will legally be allowed to do, even under the new law), it doesn’t really matter if everyone else’s landlord is nice. I’ll still be facing the tenancy tribunal and possible homelessness.

Gotta feel bad for landlords. Some of them are rich yes, but many are living from your paycheck to your next paycheck

— smooth poser (@smoothposer) March 25, 2020

Simultaneously, this entire economic situation throws into relief how few risks we seem to expect investment property buyers to be exposed to, even as the rest of the country buckles up for a rocky stretch which could last years. The more I think about it, the more absurd it seems to me that the Government would funnel literally billions of dollars into the economy – an admission that this is a crisis, that people will be struggling immensely – only for a huge chunk of that money to be funneled ever-upward to landlords who apparently must never be allowed to risk losing out on their investment.

No other way of making money is treated this way. As an employee, I accept there is a risk I could lose my job; investors on the stock market accept the values of their shares could be wiped out in a day (in fact, that’s exactly what we’ve seen happen in the last month or so). But even as everyone else grapples with their new, much grimmer, financial realities, landlords are apparently still entitled to keep collecting rent as if we weren’t staring down the barrel at what’s probably going to be the start of another great depression.

Some landlords have no other income stream, some argue. So? If the rent they collect every week dries up because tenants lose their jobs, they could go on the benefit, just like everyone else who will be made redundant in the coming depression. Freelancers and the self-employed, i.e. people running their own businesses, can seek up to $580 a week in the wage subsidy scheme if their income dries up – which, for many people, it already has. Why do we treat being a landlord so differently?

That even suggesting landlords shouldn’t have the unabated right to keep asking for rent seems so outlandish is a reflection of how out of whack with reality our ideas about property investment have become. Landlords kick up the most enormous stink every time it appears their right to earn a passive income might be impinged upon (think: threats to raise rents every time it’s suggested that perhaps homes should be insulated or have a heater in them so babies don’t die of preventable respiratory illness) and successive Governments (National and Labour) have allowed this to happen. Ardern ruled out a capital gains tax for her entire tenure as leader despite the country languishing in a housing crisis; that’s how inconceivable it’s become to even minorly affect the profit of property investors.

I’m not here to offer an airtight alternative, but I really think it’s worth deeply considering why, even in a pandemic, even when the Government is prepared to take so many extraordinary measures to protect people, even as measures like mortgage holidays acknowledge the financial devastation so many are going to face following this lockdown, the idea that landlords’ passive incomes shouldn’t be allowed to dry up seems inconceivable. I’m just asking you to think about how strange that is. Extraordinary times call for extraordinary measures. Let’s be a little more imaginative.